11+ 2017 air conditioner tax credit ideas in 2021

Home » Background » 11+ 2017 air conditioner tax credit ideas in 2021Your 2017 air conditioner tax credit images are available in this site. 2017 air conditioner tax credit are a topic that is being searched for and liked by netizens today. You can Find and Download the 2017 air conditioner tax credit files here. Download all free vectors.

If you’re searching for 2017 air conditioner tax credit images information connected with to the 2017 air conditioner tax credit topic, you have pay a visit to the right blog. Our site frequently gives you suggestions for refferencing the maximum quality video and image content, please kindly hunt and find more informative video content and images that match your interests.

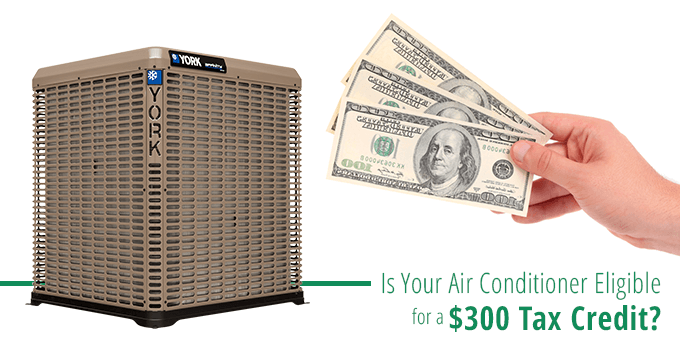

2017 Air Conditioner Tax Credit. Homeowners who replaced their older AC units and furnaces in 2016 or 2017 could earn credits up to 300. HSPF 85 and EER 125 and SEER 15 Package System. Plus good news it also retroactively applies to purchases of air conditioners and heat pumps made starting January 1 2015. Equipment Tax Credits for Primary Residences.

Lg Lw8016er 8 000 Btu Window Air Conditioner Lg Usa From lg.com

Lg Lw8016er 8 000 Btu Window Air Conditioner Lg Usa From lg.com

Depending on how old your system is a new furnace heat pump or air conditioner is going to be more efficient. HSPF 8 and EER 12 and SEER 14. But when installing or upgrading your heating ventilation and air conditioning. Equipment Tax Credits for Primary Residences. The tax credit for that is not expiring this year but in years to come the size of the tax credit starts getting smaller. Internal Revenue Service IRS is implementing.

The Residential Energy Efficiency Tax Credit covers purchases of qualifying new HVAC equipment made before December 31st 2016.

If however you installed a qualifying geothermal heat pump you may qualify for the residential energy credit Form 5695. Must be an existing home your principal residence. Here are some key facts to know about home energy tax credits. Heating Ventilating Air Conditioning HVAC As much as half of the energy used in your home goes to heating and cooling. Equipment Tax Credits for Primary Residences. Depending on how old your system is a new furnace heat pump or air conditioner is going to be more efficient.

Source: walmart.com

Source: walmart.com

Claim the credits by filing Form 5695 with your tax. The tax credit is for 300. The Homeowners Guide to Tax Credits and Rebates. We put together a big list of home improvement tax credits to help you save money on your 2016 tax return. Gas propane or oil boiler.

Source: lowes.com

Source: lowes.com

Meeting the requirements though is the condition of receiving this tax credit. The nonbusiness energy property credit expired on December 31 2017 but was retroactively extended for tax years 2018 2019 and 2020 on December 20 2019 as part of. Not only can upgrading to a high-efficiency HVAC equipment. Taxpayers who upgrade their homes to make use of renewable energy may be eligible for a tax credit to offset some of the costs. HSPF 8 and EER 12 and SEER 14.

Source: lowes.com

Source: lowes.com

Does the new tax law of 2018 restore the energy credits in 2017 for energy efficient home air conditioners and gas hot water heaters. Unfortunately for AC Contractors homeowners alike 2017 was the last year to qualify for HVAC tax credits. Meeting the requirements though is the condition of receiving this tax credit. Tuesday April 18 2017 is the deadline for filing 2016 IRS tax returns. Equipment Tax Credits for Primary Residences.

Source: ww5.cityofpasadena.net

Source: ww5.cityofpasadena.net

Equipment Tax Credits for Primary Residences. Meeting the requirements though is the condition of receiving this tax credit. We put together a big list of home improvement tax credits to help you save money on your 2016 tax return. The n onbusiness energy property tax credit expired that would have allowed you to write off a new HVAC system. Energy-efficient heating and air conditioning systems.

Source: lennox.com

Source: lennox.com

How HVAC Tax Credits Work. Advanced Main Air Circulating Fan. Tuesday April 18 2017 is the deadline for filing 2016 IRS tax returns. The tax credit is for 300. Energy-efficient heating and air conditioning systems.

Source: walmart.com

Source: walmart.com

Through the 2020 tax year the federal government offers the Nonbusiness Energy Property Credit. Tax Day 2017 will be here sooner than you think. Plus good news it also retroactively applies to purchases of air conditioners and heat pumps made starting January 1 2015. By Blairs Air Conditioning Jan 27 2017 AC Installation. Homeowners who replaced their older AC units and furnaces in 2016 or 2017 could earn credits up to 300.

Source: menards.com

Source: menards.com

For full details see the Energy Star website. Written by Doityourself Staff. The tax credit also retroactively applies to new air conditioners installed in the 2018-2020 tax year. Claim the credits by filing Form 5695 with your tax. Does the new tax law of 2018 restore the energy credits in 2017 for energy efficient home air conditioners and gas hot water heaters.

Source: lowes.com

Source: lowes.com

Under the American Taxpayer Relief Act of 2012 the US. The Consolidated Appropriations Act 2018 extended the credit through December 2017. Taxpayers claiming a credit for Qualified Energy Property should retain this Certification Statement for taxpayer records. Does the new tax law of 2018 restore the energy credits in 2017 for energy efficient home air conditioners and gas hot water heaters. How HVAC Tax Credits Work.

Source: symbiontairconditioning.com

Source: symbiontairconditioning.com

FEDERAL TAX CREDITS FOR QUALIFIED ENERGY-EFFICIENT HVAC IMPROVEMENTS RESIDENTIAL AIR CONDITIONER PRODUCT CATEGORY. On Apr 08 2010. Here are the improvements. Claim the credits by filing Form 5695 with your tax. Air Conditioners and Air Conditioner Coils and select Yes for Eligible for Federal Tax Credit.

Source: lowes.com

Source: lowes.com

The tax credit originally expired December 31 2017 If you have not previously claimed the Non-Business Energy Property Tax Credit consult with your tax professional for details. Unfortunately for AC Contractors homeowners alike 2017 was the last year to qualify for HVAC tax credits. Written by Doityourself Staff. Plus good news it also retroactively applies to purchases of air conditioners and heat pumps made starting January 1 2015. Does the new tax law of 2018 restore the energy credits in 2017 for energy efficient home air conditioners and gas hot water heaters.

Source: walmart.com

Source: walmart.com

Here are the improvements. Yes the recent passage of the 2017 Tax Law Extenders extended the already expired tax credits. HSPF 8 and EER 12 and SEER 14. The tax credit originally expired December 31 2017 If you have not previously claimed the Non-Business Energy Property Tax Credit consult with your tax professional for details. For full details see the Energy Star website.

Source: kobiecomplete.com

Source: kobiecomplete.com

The Homeowners Guide to Tax Credits and Rebates. Written by Doityourself Staff. The Consolidated Appropriations Act 2018 extended the credit through December 2017. Internal Revenue Service IRS is implementing. We put together a big list of home improvement tax credits to help you save money on your 2016 tax return.

Source: pinterest.com

Source: pinterest.com

The tax credit is for 300. Air-source heat pumps 300 tax credit. Written by Doityourself Staff. We put together a big list of home improvement tax credits to help you save money on your 2016 tax return. Tax Day 2017 will be here sooner than you think.

Source: lg.com

Source: lg.com

10 of cost up to 500 or a specific amount from 50-300. Energy-efficient heating and air conditioning systems. Advanced Main Air Circulating Fan. The n onbusiness energy property tax credit expired that would have allowed you to write off a new HVAC system. Americans from Tax Hikes Act of 2015.

Source: lg.com

Source: lg.com

The Residential Energy Efficiency Tax Credit covers purchases of qualifying new HVAC equipment made before December 31st 2016. Air Conditioner Tax Credit 2017. Depending on how old your system is a new furnace heat pump or air conditioner is going to be more efficient. Claim the credits by filing Form 5695 with your tax. The Homeowners Guide to Tax Credits and Rebates.

Source: lowes.com

Source: lowes.com

The nonbusiness energy property credit expired on December 31 2017 but was retroactively extended for tax years 2018 2019 and 2020 on December 20 2019 as part of. We also included information on rebates for energy-efficient appliances to help you save money if you needwant to use your tax savings on energy-efficient appliances. Written by Doityourself Staff. Americans from Tax Hikes Act of 2015. Advanced Main Air Circulating Fan.

Source: pinterest.com

Source: pinterest.com

Residential Air-Source Heat Pumps. Depending on how old your system is a new furnace heat pump or air conditioner is going to be more efficient. Taxpayers who upgrade their homes to make use of renewable energy may be eligible for a tax credit to offset some of the costs. Energy-efficient heating and air conditioning systems. Here are the improvements.

Source: walmart.com

Source: walmart.com

10 of cost up to 500 or a specific amount from 50-300. The Homeowners Guide to Tax Credits and Rebates. Here are the improvements. Air Conditioner Tax Credit 2017. If your home system meets the requirements a tax credit consisting of 30 percent of the cost up to 1500 is in order.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title 2017 air conditioner tax credit by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.