26+ Air conditioner depreciation life rental information

Home » Background » 26+ Air conditioner depreciation life rental informationYour Air conditioner depreciation life rental images are available. Air conditioner depreciation life rental are a topic that is being searched for and liked by netizens now. You can Download the Air conditioner depreciation life rental files here. Find and Download all royalty-free photos and vectors.

If you’re looking for air conditioner depreciation life rental images information connected with to the air conditioner depreciation life rental topic, you have pay a visit to the ideal site. Our website frequently gives you suggestions for viewing the highest quality video and image content, please kindly search and locate more enlightening video articles and graphics that fit your interests.

Air Conditioner Depreciation Life Rental. You can create air conditioner depreciation under the betterment classification if. Added a new air conditioner to a rental property. The equipment and labor for installation cost 200000. Air Conditioner Depreciation And Rental Unit Owners.

Buying Your First Rental Property Ultimate Guide Learn How To Buy A Rental And Create Passive Income From yesirent.com

Buying Your First Rental Property Ultimate Guide Learn How To Buy A Rental And Create Passive Income From yesirent.com

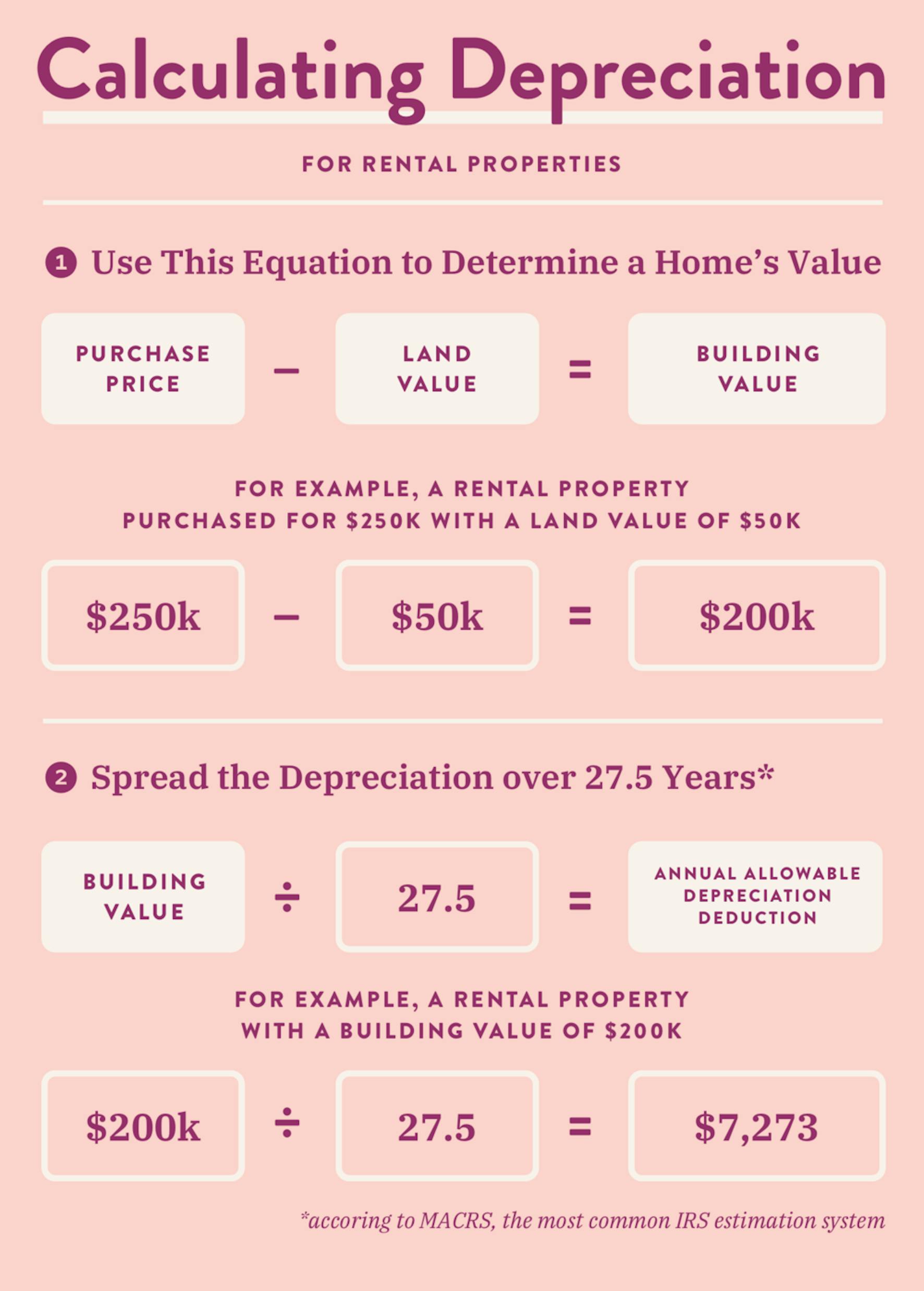

However in order to take advantage of it your property will have to show a profit. The simple answer to this question is no HVAC systems do not qualify for bonus depreciation. The first thing that real estate owners need to know about bonus depreciation is that it cannot be used on rental properties themselves. When you own a business being able to keep your employees and your customers comfortable day in and day out is an absolute necessity. The cost of an air conditioner is considered a depreciating asset where you can claim a deduction for decline in value over a number of years. 87-57 which addresses the manner of computing depreciation deductions in Sections 2-7 and in Section 8.

When you own a business being able to keep your employees and your customers comfortable day in and day out is an absolute necessity.

2019-8 offers an optional alternative depreciation table using a straight-line method a midmonth convention and a 30-year recovery period. Specifically the bonus depreciation method isnt allowed on assets with a useful life of 20 years or more. Added a new air conditioner to a rental property. Air handler used to condition or circulate the air within the HVAC system. However the SHST may only be used for rental buildings that cost 1 million or less. At a 35 percent tax rate that owner would only save around 1795.

Source: mwellp.com

Source: mwellp.com

HVAC now qualifies for Section 179 expense deduction. You can create air conditioner depreciation under the betterment classification if. Business owner installs a new heating and air-conditioning system with equipment and installation cost of 1000000. The simple answer to this question is no HVAC systems do not qualify for bonus depreciation. This is known as a single deduction.

Source: pinterest.com

Source: pinterest.com

The evaporator is the cold side of an air conditioner or heat pump. Business owner installs a new heating and air-conditioning system with equipment and installation cost of 1000000. Added a new air conditioner to a rental property. An air handler usually contains a blower heating or cooling elements filter racks or chambers sound attenuators and dampers. I would normally depreciate the HVAC unit for 275 yrs.

Source: learn.roofstock.com

Source: learn.roofstock.com

A business owner installs a new heating and air-conditioning rooftop unit. 5 days ago Jul 18 2017 First if you repair an item like an AC unit you can deduct the total cost of the repair on that individual year taxes. Added a new air conditioner to a rental property. Air Conditioner Depreciation And Rental Unit Owners. Air handler used to condition or circulate the air within the HVAC system.

Source: yesirent.com

Source: yesirent.com

Second according to current IRS tax regulations if you replace the unit you have the option to depreciate that cost and spread it out over a. The IRS determines the useful lives of different types of assets. Before the Section 179 change depreciation rules applied and the owner could only deduct around 5130 per year. One unit was 3300 the other 2495. The first thing that real estate owners need to know about bonus depreciation is that it cannot be used on rental properties themselves.

Source: scottsdaleair.com

Source: scottsdaleair.com

Under old depreciation rules the owner could only claim approximately 350 in depreciation expense annually over a 39-year period. You can create air conditioner depreciation under the betterment classification if. As for depreciation if they are part of the central HVAC system you have to depreciate them over 275 years. Before the Section 179 change depreciation rules applied and the owner could only deduct around 5130 per year. Air Conditioner Depreciation And Rental Unit Owners.

Source: pinterest.com

Source: pinterest.com

At a 35 percent tax rate that owner would only save around 1795. The evaporator is the cold side of an air conditioner or heat pump. Specifically the bonus depreciation method isnt allowed on assets with a useful life of 20 years or more. The total cost of the equipment and labor for installation is 14000. The first thing that real estate owners need to know about bonus depreciation is that it cannot be used on rental properties themselves.

Source: wealthfit.com

Source: wealthfit.com

And the annual SHST deduction is limited to the lesser of 10000 or 2 of the unadjusted basis of the building. 87-57 which addresses the manner of computing depreciation deductions in Sections 2-7 and in Section 8. If they are stand alone units more like window. I purchased two HVAC systems this year for two different rental properties. When it comes to appliances used in rental property including air conditioning units the recovery period is 5 years.

Source: mwellp.com

Source: mwellp.com

Added a new air conditioner to a rental property. Second according to current IRS tax regulations if you replace the unit you have the option to depreciate that cost and spread it out over a. However air conditioning and heating systems do qualify as section 179 equipment. The simple answer to this question is no HVAC systems do not qualify for bonus depreciation. Under old depreciation rules the owner could only claim approximately 350 in depreciation expense annually over a 39-year period.

Source: wealthfit.com

Source: wealthfit.com

The recovery period on Form 4562 comes from this determination. Under old depreciation rules the owner could only claim approximately 350 in depreciation expense annually over a 39-year period. Added a new air conditioner to a rental property. Specifically the bonus depreciation method isnt allowed on assets with a useful life of 20 years or more. Business owner installs a new heating and air-conditioning system with equipment and installation cost of 1000000.

Source: wealthfit.com

Source: wealthfit.com

Second according to current IRS tax regulations if you replace the unit you have the option to depreciate that cost and spread it out over a. 5 days ago Jul 18 2017 First if you repair an item like an AC unit you can deduct the total cost of the repair on that individual year taxes. This is called the assets class life. At a 35 percent tax rate that owner would only save around 1795. One unit was 3300 the other 2495.

Source: wealthfit.com

Source: wealthfit.com

87-57 which addresses the manner of computing depreciation deductions in Sections 2-7 and in Section 8. When you own a business being able to keep your employees and your customers comfortable day in and day out is an absolute necessity. The evaporator is the cold side of an air conditioner or heat pump. HVAC Depreciation Life 2020 What You Need To Know In this guide we discuss important factors that affect HVAC depreciation life and everything you need to know about the depreciation life of a HVAC system. A business owner installs a new heating and air-conditioning rooftop unit.

Source: scottsdaleair.com

Source: scottsdaleair.com

Evaporators can be used to absorb heat from air or from a liquid. This is called the assets class life. The evaporator is the cold side of an air conditioner or heat pump. Second according to current IRS tax regulations if you replace the unit you have the option to depreciate that cost and spread it out over a. HVAC Depreciation Life 2020 What You Need To Know In this guide we discuss important factors that affect HVAC depreciation life and everything you need to know about the depreciation life of a HVAC system.

Source: seekingalpha.com

Source: seekingalpha.com

Before the Section 179 change depreciation rules applied and the owner could only deduct around 5130 per year. This is outlined in our Guide for rental property owners 2019 under Deduction for decline in value of depreciating assets on page 21. Business owner installs a new heating and air-conditioning system with equipment and installation cost of 1000000. And the annual SHST deduction is limited to the lesser of 10000 or 2 of the unadjusted basis of the building. The simple answer to this question is no HVAC systems do not qualify for bonus depreciation.

Source: wealthfit.com

Source: wealthfit.com

Air handler used to condition or circulate the air within the HVAC system. Under the previous depreciation rules the business owner would claim approximately 25641 in depreciation deductions annually over 39 years for a year one net equipment cost of 994616. You can create air conditioner depreciation under the betterment classification if. However the SHST may only be used for rental buildings that cost 1 million or less. When you own a business being able to keep your employees and your customers comfortable day in and day out is an absolute necessity.

Source: turbotax.intuit.ca

Source: turbotax.intuit.ca

The recovery period on Form 4562 comes from this determination. Bonus depreciation for rental property owners. Before the Section 179 change depreciation rules applied and the owner could only deduct around 5130 per year. However in order to take advantage of it your property will have to show a profit. However the SHST may only be used for rental buildings that cost 1 million or less.

Source: pinterest.com

Source: pinterest.com

The simple answer to this question is no HVAC systems do not qualify for bonus depreciation. This is called the assets class life. The equipment and labor for installation cost 200000. Under old depreciation rules the owner could only claim approximately 350 in depreciation expense annually over a 39-year period. For such residential rental property Rev.

Source: wealthfit.com

Source: wealthfit.com

This is called the assets class life. The simple answer to this question is no HVAC systems do not qualify for bonus depreciation. Evaporators can be used to absorb heat from air or from a liquid. If you have any questions or concerns about if you are filing your commercial taxes properly working with a tax agent may be your best option to ensure you are getting. The total cost of the equipment and labor for installation is 14000.

Source: mlrpc.com

Source: mlrpc.com

The total cost of the equipment and labor for installation is 14000. The cost of an air conditioner is considered a depreciating asset where you can claim a deduction for decline in value over a number of years. Before the Section 179 change depreciation rules applied and the owner could only deduct around 5130 per year. The first thing that real estate owners need to know about bonus depreciation is that it cannot be used on rental properties themselves. Depreciation is reported on IRS Form 4562.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title air conditioner depreciation life rental by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.